TAX TIPS

October 01, 2024

The short answer is yes.

If you operate a limited company, you can write-off 100% of the cost of a mobile phone through your business.

For any tax enthusiasts out there, this is detailed in HMRC's Employment Income Manual 21779.

You can write off all costs of the mobile phone.

This includes the cost of the mobile phone itself, a monthly contract and any additional charges incurred in its use e.g. for foreign calls that fall outside the contract allowance.

Furthermore, all costs for your private calls are even covered too with no National Insurance or benefit in kind to pay.

It's an amazing advantage of running a limited company, and can make you hundreds of pounds better off versus buying the phone personally.

In order to expense the phone through your business, there are however some key rules to be aware of.

These conditions are very easy to satisfy, however it's worth stressing that you can only write off the cost of a mobile for employees or directors of your limited company.

That means you cannot provide a mobile phone to family members tax free - unless they are employed by your company.

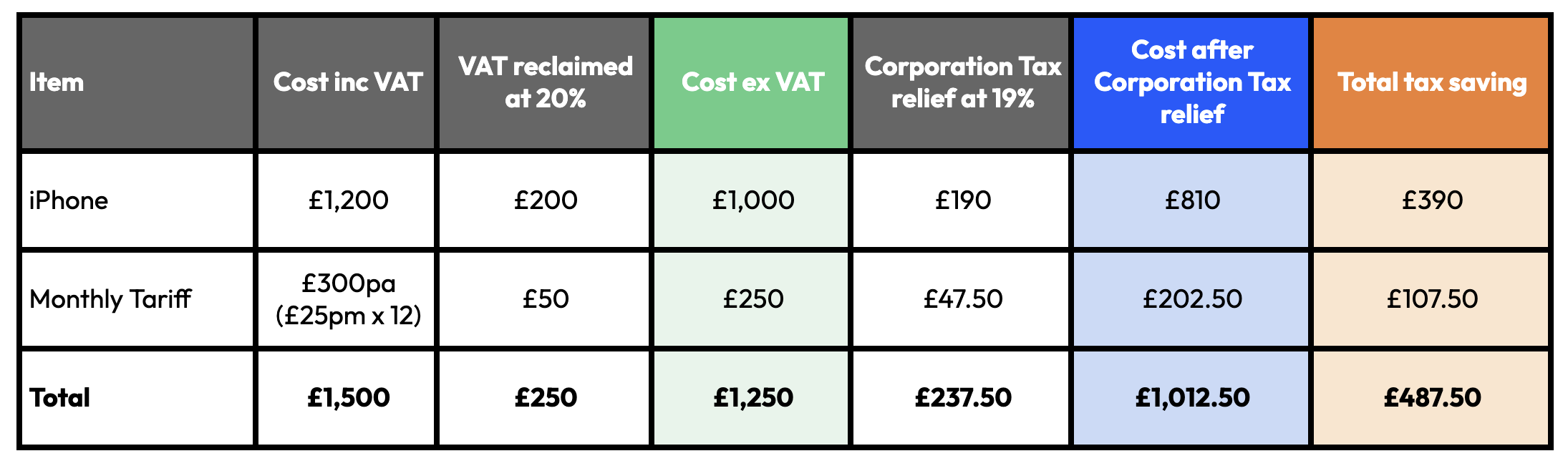

To show you how amazing this benefit is, let's use some real numbers.

Let's assume you want to buy Apple's latest iPhone for £1200 with a £25 sim-only monthly tariff to cover all your calls, data and texts.

If you were to do this in your personal name, it would cost you £1200 for the phone plus £25 a month - equivalent to £300 a year (£25 x 12).

So for the first 12 months this would therefore cost you a total of £1500.

If you're a director of a VAT registered company and want to buy the exact same phone and tariff through the business, the real cost to your company is completely different.

Firstly, if you're VAT registered you can reclaim all VAT on the phone and monthly tariff if the phone is for business purposes only. On a £1200 phone, that means you can instantly reclaim £200 of VAT on a £1200 phone. In other words, the phone costs £1000 ex VAT

On a £25pm / £300 per year tariff, you can also instantly reclaim the VAT. That's a total VAT recovered of £50. In other words the tariff only costs £250 per year ex VAT.

You can then write-off the remaining £1000 phone cost and £250 tariff against your profits for further tax savings.

In 2023/2024 the rate of corporation tax will vary between 19% to 25% depending upon how much profit you make. However to keep the numbers simple, let's assume you're taxed at the minimum rate of 19%.

After reclaiming VAT and writing off remaining cost against corporation tax, putting a mobile phone through the business only costs the company £1012.50.

You can see this in the blue column below.

Compare this against the £1,500 cost of buying the EXACT same phone and tariff in your personal name, and you're a whopping £487.50 better off. This is shown in the orange column above.

That's equivalent to a 32% saving vs buying the phone personally - and because of the incoming new sliding scale for corporation tax, the more profitable your company is, the bigger the tax write off will be. That's the minimum tax saving you'll make

If you bought the phone as an individual (not a company) that's not VAT registered and you were paying income tax at the Higher Rate of 40%, you would have to earn an extra £2500 to buy the very same £1500 phone and tariff!

Working out: (£2500 * 40% Higher Rate Income Tax = £1000 Income Tax. This leaves you with £1500).

In other words, to buy the phone personally you would have to earn £2,500 vs buying the phone through the business with an effective cost of just £1012.50.

Crazy right! It really does pay to operate as a company!

If you operate a company: