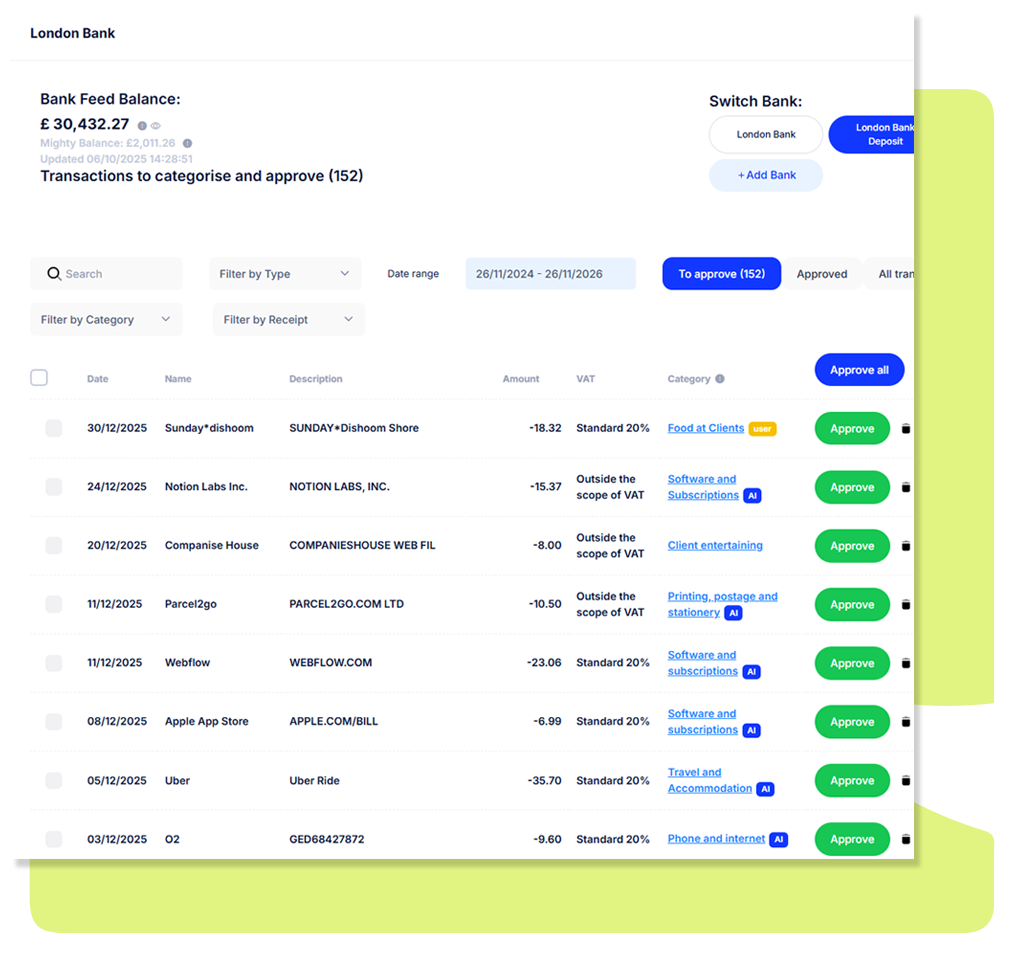

Connect your bank account to Mighty to automatically sync transactions into the platform.

Mighty automatically suggests categories for most transactions based on their description. As you review and categorise transactions, Mighty learns from these and suggests the same categories for future transactions.

Manually edit or categorise transactions in a click, or create custom rules for recurring items so you don't have to review the same transactions twice.

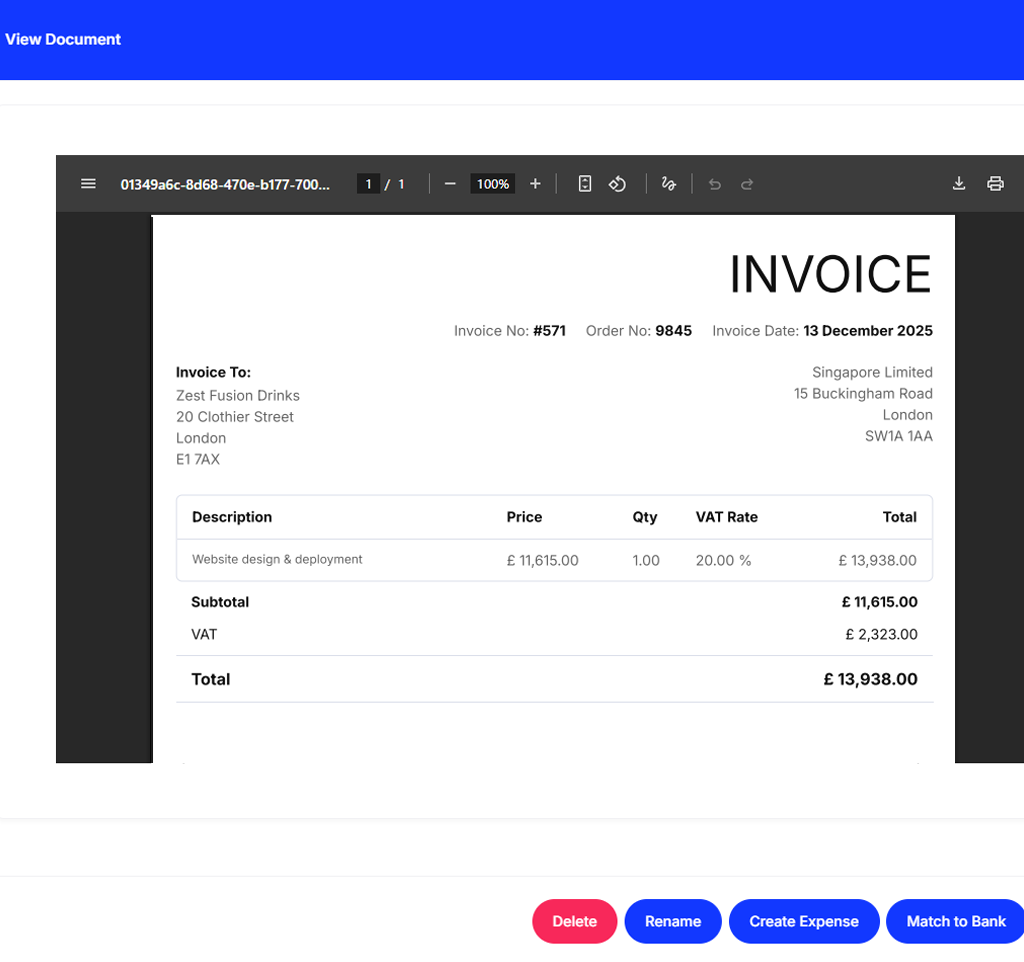

Snap a photo of receipts and forward them to your unique Mighty email address. They'll appear in one place, ready to be matched to a bank transaction or used to create an expense claim.

Mighty extracts key details from receipts, emails and PDFs, and uses them to automatically create draft expense claims saving you manual data entry.

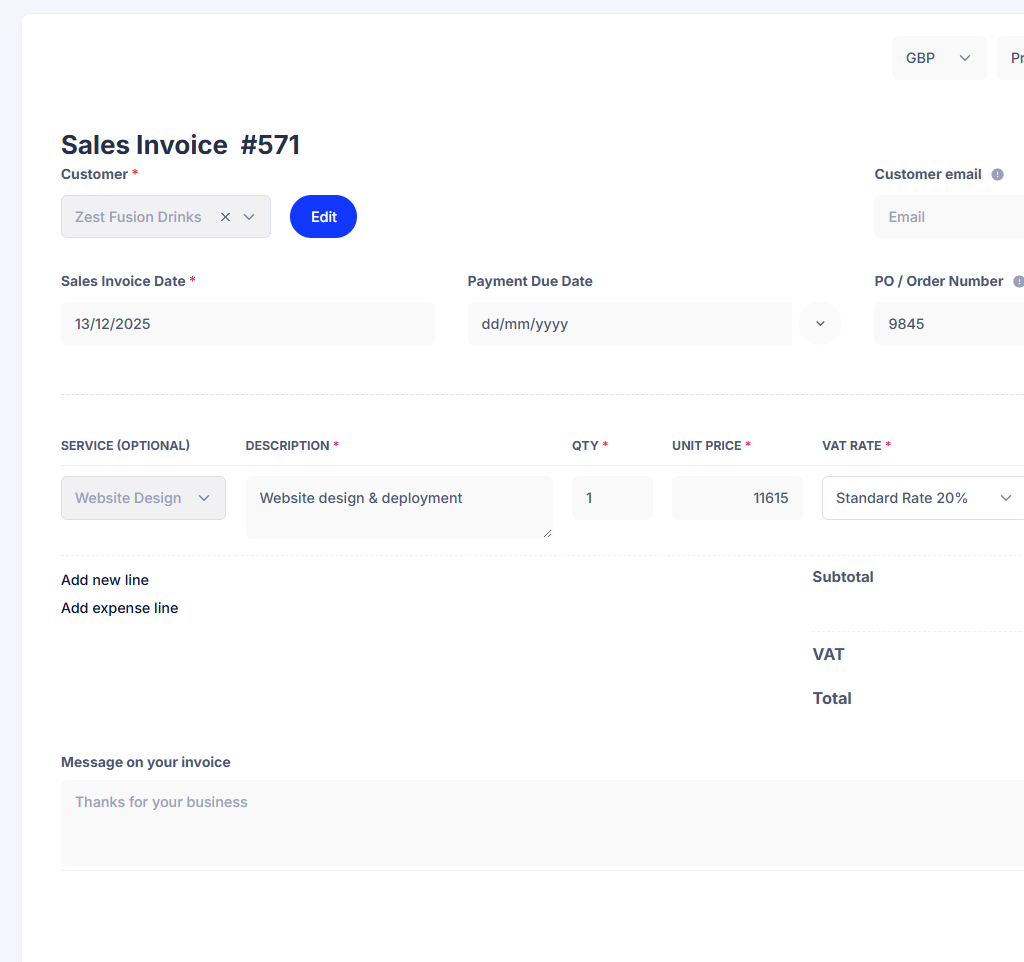

Create custom invoices in seconds, download them or send them via email through Mighty's platform.

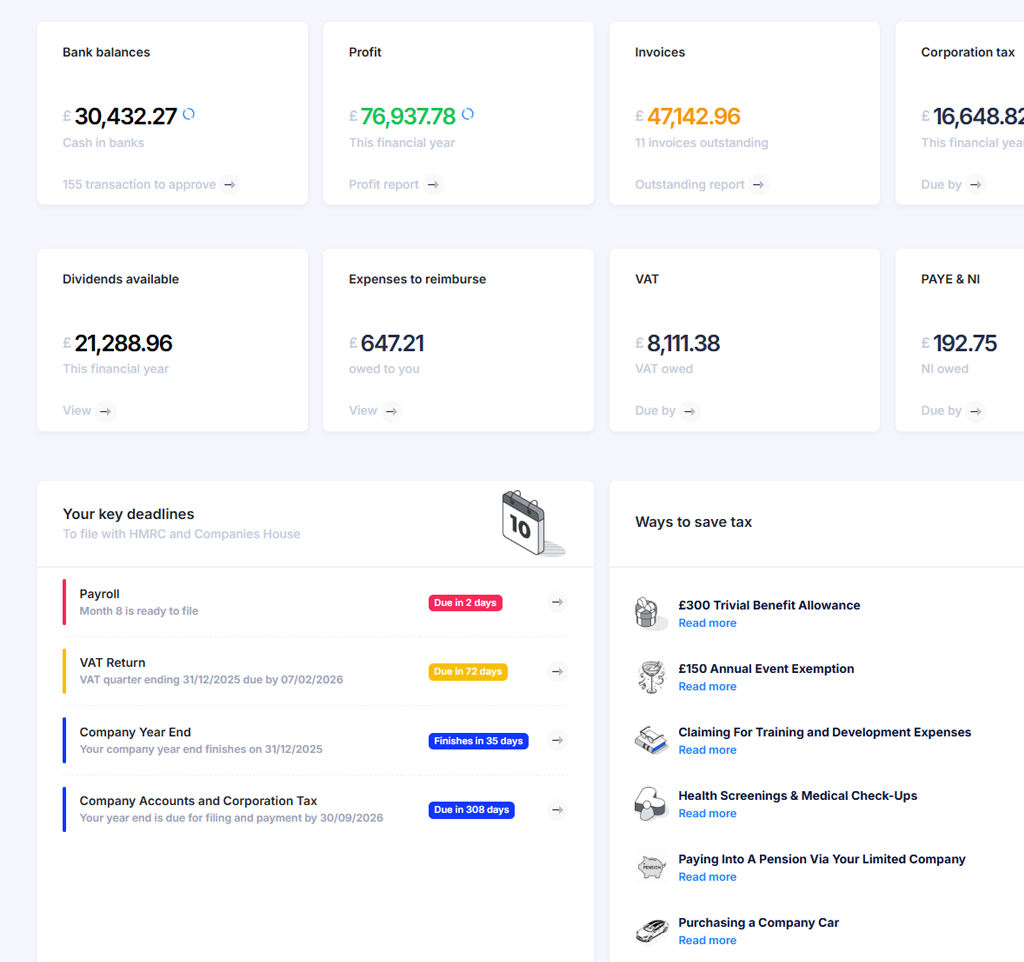

Stay on top of your finances by instantly seeing what invoices are due and overdue

Create expense claims for costs you’ve paid personally and reimburse yourself through your company. Receipts can be attached in a click, with details automatically extracted via Mighty’s Postbox.

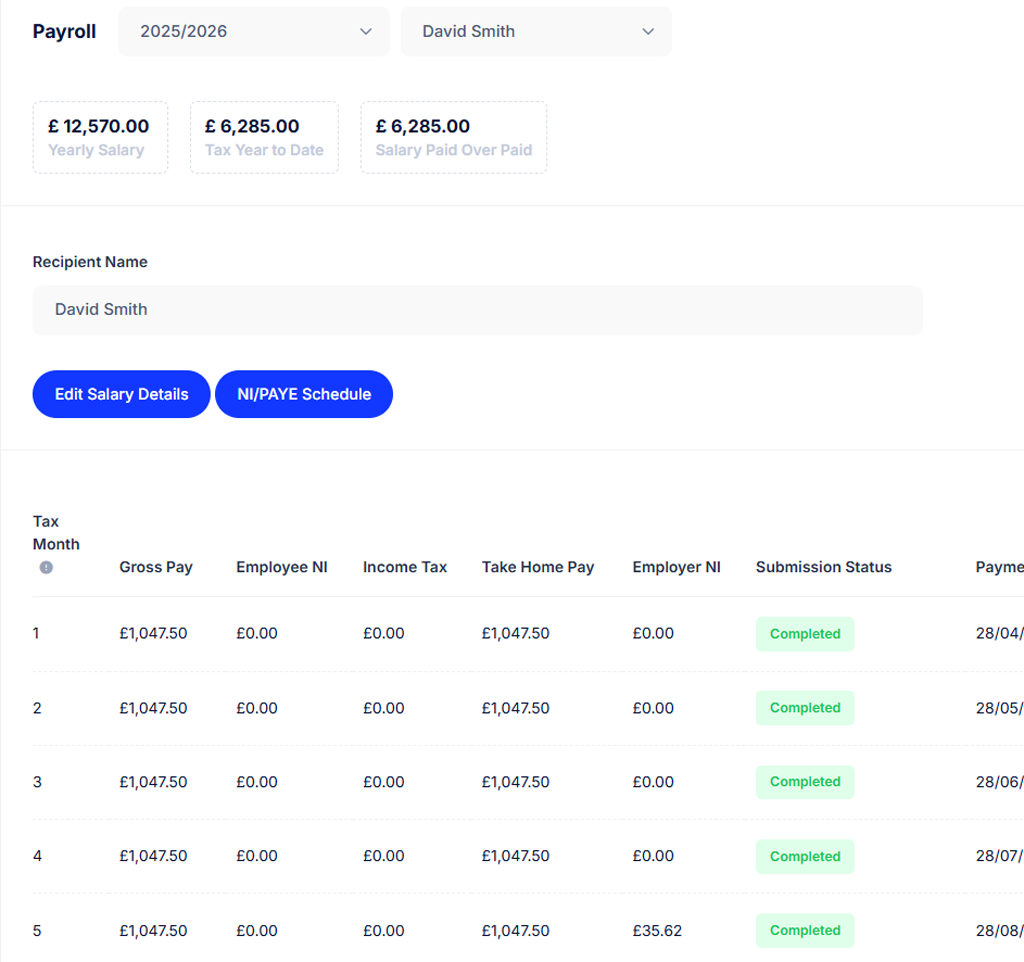

Mighty runs your payroll each month and submits it to HMRC, keeping you compliant and paid on time. Payslips and P60s are generated automatically, while our accountants set everything up and review submissions to make sure it's done correctly.

Declare and pay dividends through Mighty's dedicated dividends screen. Dividend vouchers and board minutes are generated automatically, with accountant support available when you need it.

Easily claim back out of pocket expenses for mileage or money you've personally spent on the business

Mighty is Making Tax Digital compliant and calculates your VAT returns automatically using live financial data. Our accountants review everything for accuracy, then file with HMRC once you've approved it.

Payroll RTI submissions are filed automatically through the software, with PAYE and National Insurance schedules clearly shown so you know exactly what's due and when.

Corporation tax is calculated on an ongoing basis so you always know where you stand. At year end, we prepare and file your statutory accounts and corporation tax return.

Mighty tracks all your company's key tax and filing deadlines in one place. You'll see them in your dashboard, with automated reminders and support from our team throughout the year.

See a clear, real-time breakdown of your company's tax position, with no nasty surprises.

Get a real-time snapshot of your company's key financial data, including cash in the bank, profit, outstanding invoices and upcoming tax bills.

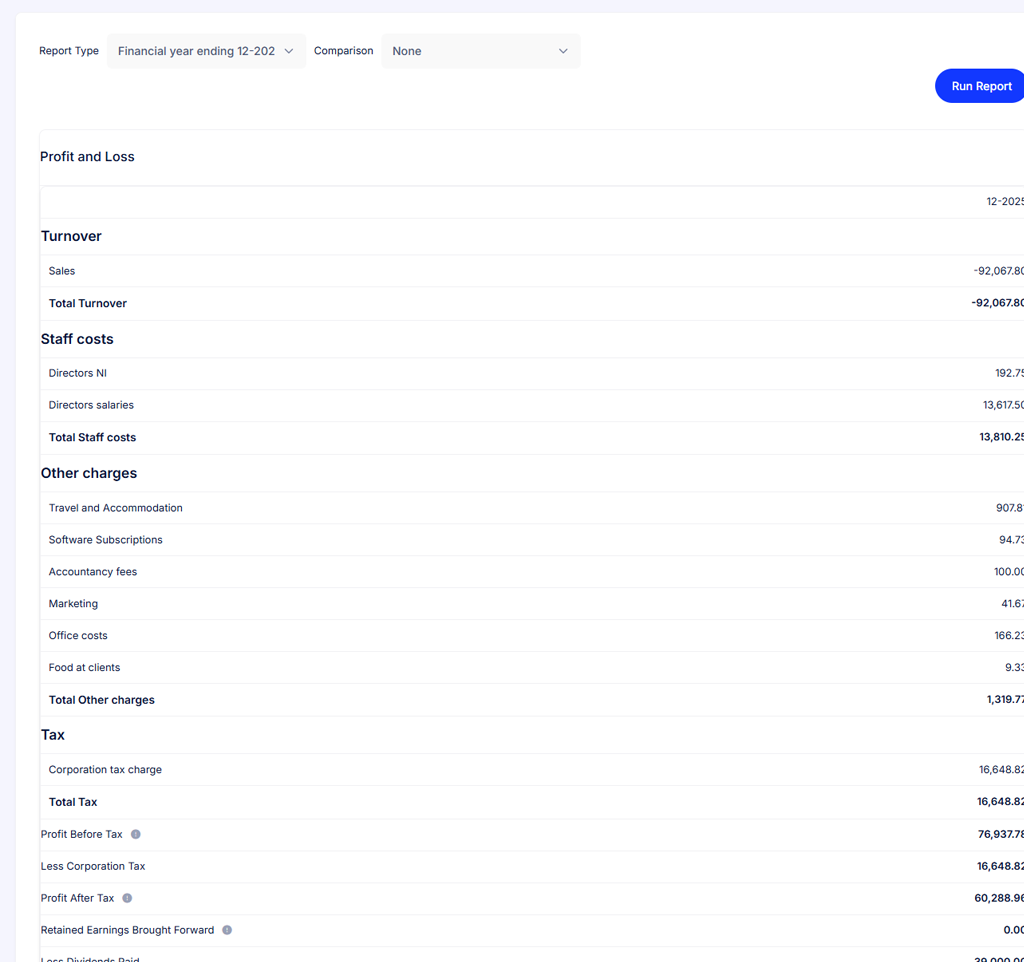

Drill down into your numbers with clear reports such as profit and loss, balance sheet and transaction breakdowns.

Instantly see which invoices are due or overdue, so you can stay on top of cash flow and get paid on time.

See your upcoming tax and filing deadlines clearly, with reminders built into the platform so nothing is missed.

Track income, costs, time and budgets against individual projects to understand exactly how profitable each piece of work is.

All your accounting. One plan. No hidden costs.

One fixed fee, so we start with a conversation, not a quote

Comprehensive Accounting Services Including

One fixed fee, so we start with a conversation, not a quote

Comprehensive Accounting Services Including

Speak with a fully qualified Mighty accountant

We're here to help. Ask any question you like? e.g. I have a spouse who works in the company?